From AI Chaos to Instant Clarity

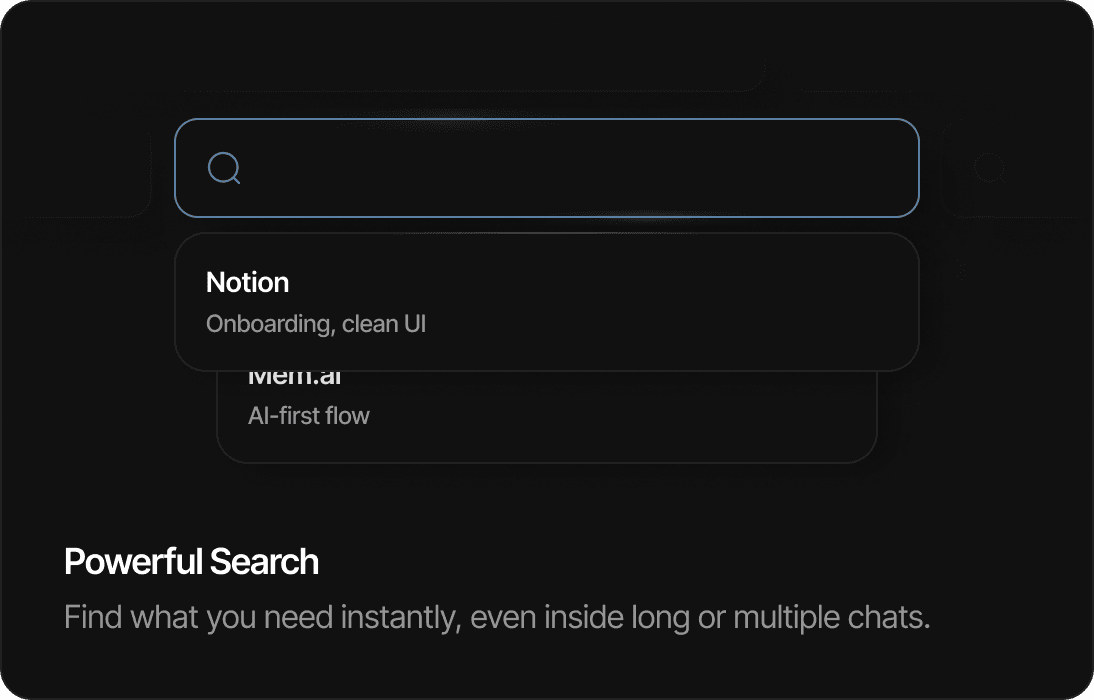

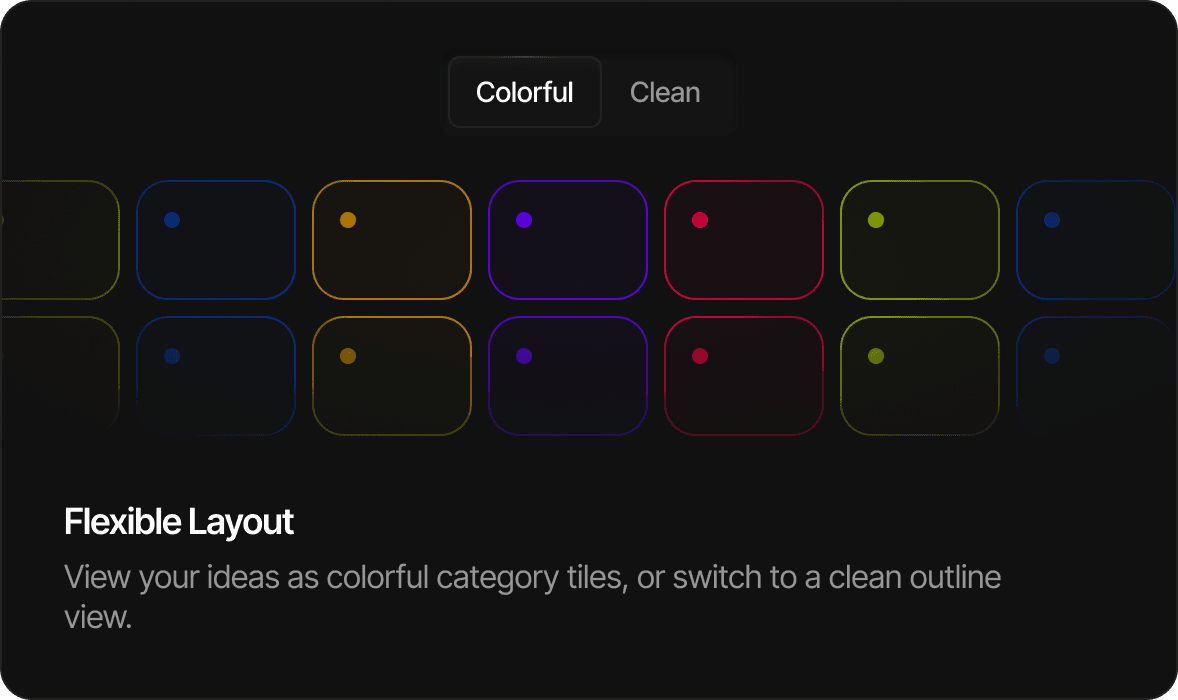

Paneglass cuts through the noise, turning endless AI threads into sharp summaries and searchable boards so you can focus on building, creating, and executing.

Before

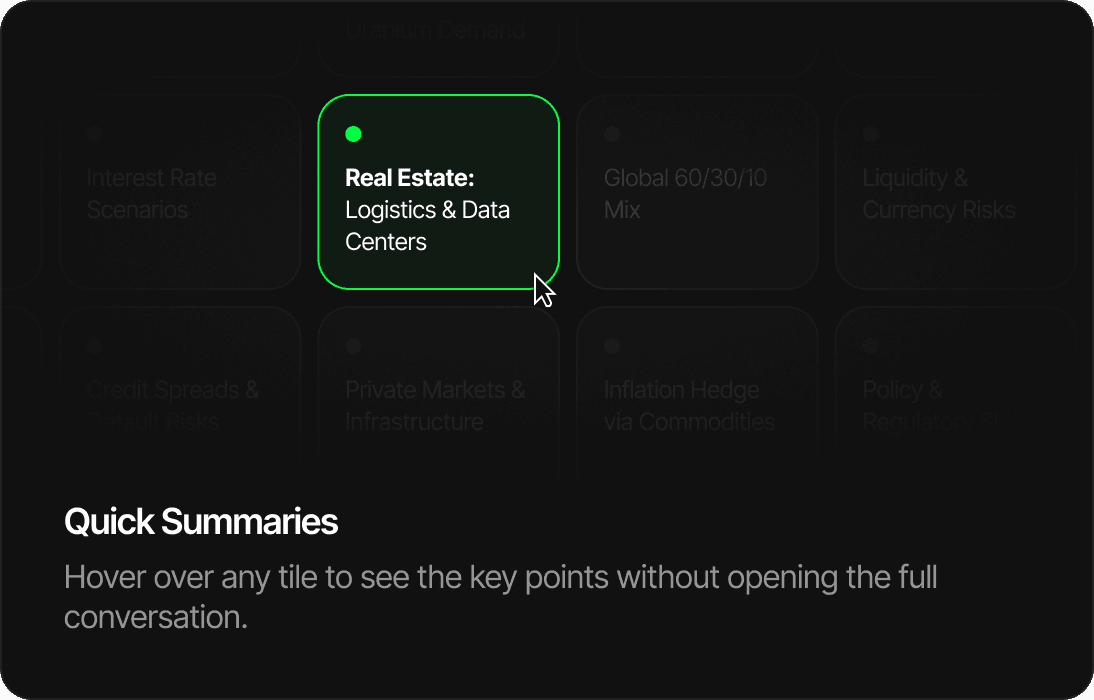

Where are the best opportunities right now?

Equities could offer upside, especially in emerging markets and AI-related sectors, but volatility remains high. Bonds are offering higher yields than they have in years — especially Treasuries and investment-grade corporates. Commodities like copper and uranium are benefiting from long-term structural demand. Real estate is mixed: residential faces affordability issues, but logistics and data centers tied to AI are seeing growth.

What about risks?

Geopolitical tensions could disrupt supply chains, interest rates may remain elevated longer than expected, and liquidity is tightening. Emerging markets face currency risk.

How should I allocate across them?

One approach could be a barbell portfolio: growth equities + stable bonds, with a slice of commodities for inflation hedge. Alternatively, a global 60/30/10 mix (equities/bonds/alternatives).

After

AI & Emerging Market Opportunities

Treasury & Corporate Bond Yields

Commodities: Copper & Uranium Demand

Barbell Allocation Approach

Geopolitical Tensions

3-5 Year Growth Outlook

Volatility & Currency Risks

Interest Rate Scenarios

Real Estate: Logistics & Data Centers

Global 60/30/10 Mix

Liquidity & Currency Risks

Short-Term Safe Havens

Sector Themes: Tech, Energy, Industrials

Credit Spreads & Default Risks

Private Markets & Infrastructure

Inflation Hedge via Commodities

Policy & Regulatory Shifts

Long-Term Structural Trends